Escola Virtual do Governo oferece 612 cursos online EAD, totalmente gratuitos e com certificado garantido nas áreas da construção civil, logística, beleza, direito, indústria, saúde e muito mais

19 de abril de 2024 —

Flavia Marinho

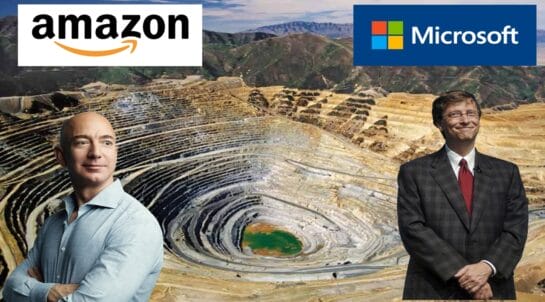

Conheça por que gigantes tecnológicos como Microsoft e Amazon estão investindo milhões em uma empresa de mineração que usa inteligência artificial para buscar metais raros

19 de abril de 2024 —

Noel Budeguer

Navio ‘Green Santos’ conclui viagem histórica à China com 72 Mil toneladas de celulose Suzano

19 de abril de 2024 —

Keila Andrade