Fundação abre edital de concurso com 594 vagas na área da Saúde (Copeiro, Enfermagem, Fisioterapia, Assistente Social, Farmácia, Nutrição, Psicologia e mais) com salário de até R$ 8,1 mil

26 de abril de 2024 —

Flavia Marinho

China cria SOL artificial 13x mais potente que o sol original e PROVA seu PODER TECNOLÓGICO com 200 milhões de graus Celsius!

26 de abril de 2024 —

Valdemar Medeiros

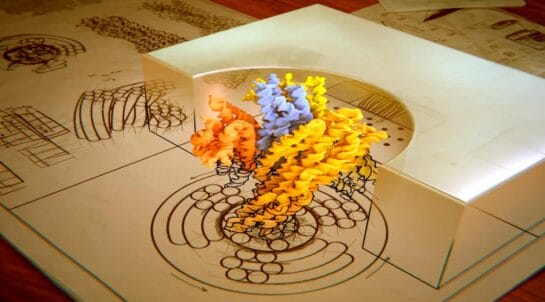

Engenheiros criam nanoturbina poderosa, construída a partir do próprio DNA, que promete revolucionar os nanomotores e as nanomáquinas no mundo!

26 de abril de 2024 —

Flavia Marinho